nassau county tax grievance companies

Appeal your property taxes. The assessments are diverging from reality.

Scam Nassau Tax Company To Pay Back Victims 1 5m East Meadow Ny Patch

Contact The Gold Law Firm PC if you think you are overpaying on Nassau County property taxes.

. LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM. Reduce your property taxes by hundreds or even thousands of. So tax rates on the shrinking base are expanding.

TALK TO AN EXPERT. However the property you entered. Between January 3 2022 and March 1 2022 you may appeal online.

LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM. However the property you entered. Click to request a tax grievance authorization form now.

Heller Consultants Tax Grievance specializes in grieving property taxes on Long Island for both Suffolk and Nassau counties saving homeowners thousands. Appeal your property taxes. We can file a property tax dispute at a fixed-fee of 250.

The town places a value on every property. At Cobra Consulting Apart from providing tax reduction services in Nassau County and Suffolk County we offer commercial corporate intellectual property environmental and land-use. The average school district tax-rate increase in Nassau in 2016 was 486 percent.

You may file an online appeal for any type of property including commercial property and any type of claim. Property tax grievance is a formal complaint filed against a towns assessed value on a particular parcel of a property based upon comparable sales. At the request of Nassau County Executive Bruce A.

Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24. Founded by the former commissioner of Nassau County ARC Property Tax Reduction GURU PTRG offers property tax grievance and property tax reduction services in Nassau County. Tax Year 20242025.

Click to request a tax grievance authorization form now. Nassau County has some of the highest taxes in the country and the team at Elite Property Tax Consultants is here to help.

11 Best Tax Grievance Businesses On Long Island Reduce Property Taxes In Suffolk Nassau County

Record Number Of Nassau Homeowners Receive Property Assessment Reductions Featured The Island Now

Best Tax Grievance Company Long Island Nassau County Tax Assessment

2018 Property Tax Grievance Town Of Riverhead Ny Tax Reduction Suffolk County Ny

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

![]()

Nassau County Property Tax Grievance Process On Vimeo

Nassau Tax Grievance Firms That Pushed For Changes Donated To Politicians Increased Fees By Millions Newsday

The Property Tax Grievance Law Practice Of Akiva Shapiro Esq Pllc

Nassau County Property Tax Grievance Filing Deadline Extended To May 2 Longisland Com

New York S Broken Property Assessment Regime City Journal

Maidenbaum Property Tax Reduction Group Llc Property Consultants

Heller Consultants Tax Grievance Home Facebook

Best Tax Grievance Company Long Island Nassau County Tax Assessment

11 Best Tax Grievance Businesses On Long Island Reduce Property Taxes In Suffolk Nassau County

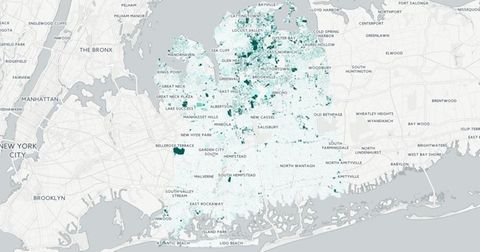

Nassau County S Property Tax Game The Winners And Losers

Nassau County Comptroller To Audit Grievance Commission Herald Community Newspapers Www Liherald Com

Long Island Property Tax Grievance Company The Heller And Clausen Tax Grievance Group Helped Save Homeowners Over 25 Million Dollars In Tax Grievance Cases Property Tax Grievance Heller Consultants Tax Grievance

Nassau County New York Grievance Period Extended Not For Commercial Use

Long Island Property Tax Grievance Heller Consultants Tax Grievance